The US dollar gained against most of the major foreign currencies last week, but the overall tone, leaving aside the yen, was largely consolidative in nature. The greenback was soft in the first half of the week but recovered in the second half.

The Australian and Canadian dollars were the only major currencies that managed to hold onto some of their gains (0.55% and 0.40% respectively). The yen was the weakest of the majors, losing 1.2%, as the panic from the week before died down. Equity markets were mostly higher, with the Nikkei's 5.2% rise, leading the major markets. US 10-year Treasury yields rose 8 bp. Core bonds generally traded heavier, but European peripheral bonds were firmer, in line with the calmer conditions.

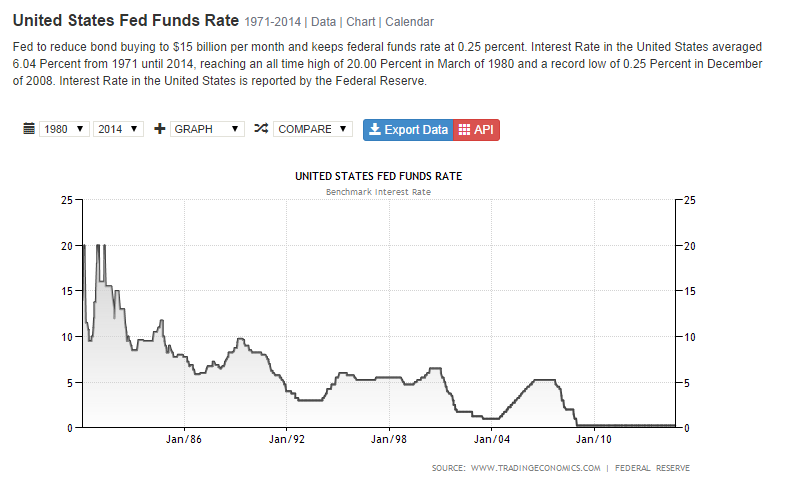

We were never persuaded that last week's turmoil would prevent the Fed from completing its tapering operation, and see that in the market, cooler heads are prevailing. Talk of "tapering the tapering" has diminished, and no one is taking too seriously the prospects of QE4. Nevertheless, we note that both the December 2015 Fed funds and eurodollar futures contracts were unchanged on the week at 46 bp and 77 bp respectively.

Perhaps offsetting the diminished interest rate support for the dollar has been speculation that more action from the European Central Bank and the Bank of Japan could be imminent. Reports suggested that the ECB may consider adding corporate bonds to its asset purchase program. There were also report suggesting that the BOJ sees risk that inflation may fall, and this could prompt an extension of the already aggressive Qualitative and Quantitative Easing. We are skeptical that either will materialize in the coming weeks. The BOJ meets next week and the ECB the following week.

Technically, the euro looks poised to continue to consolidate. Most of last week's price action took place within the $1.2625-$1.2886 range set on October 15. In recent session, the euro flirted with the lower end and slipped to about $1.2615. The euro spent the second half of the week below the 20-day moving average, which comes in near $1.2690. This is the nearby cap. Of note, the nearly four-cent bounce in the euro has not been accompanied by a sharp change in euro positioning The confidence of the euro bears is palpable and quite widespread.

The bearishness toward the yen was more evident in the price action than in the euro. We had identified the yen's gains as among the most exaggerated in last week's technical note. The dollar's recovery last week recouped 61.8% of its slide from the push marginally above JPY110 on October 1. It closed above its 20-day moving average in the two sessions before the weekend for the first time since early this month. The RSI has been recovering, and the MACDs have now crossed higher. The risk is that the speculation of more action by the BOJ is getting ahead of itself. This may help cap the dollar, where a trendline drawn off the early October highs comes in around JPY108.70-80 next week.

From a technical perspective, sterling continues to look constructive.Bullish divergence continues to be evident in the daily RSI and MACD. It could be important that the $1.60 area largely held in the second half of last week. It appears that sterling may be carving out a head and shoulder near $0.8650. Before the weekend, the aussie tested both sides of the pattern. It closed firm, in an outside day, though off its high and just below the previous day's high. This is still impressive because of increased speculation that the central bank is considering cutting interest rates. This chart pattern is notorious for false breaks, and the technical indicators do not appear to be generating strong signals.

The US dollar pulled back against the Canadian dollar to challenge the past month's uptrend. It is found near the 20-day moving average, just above CAD1.1210. The US dollar could not get back above CAD1.13 in the first half of the week and came down to test CAD1.1180-CAD1.1200 in the second half of the week. It has been unable to close below the 20-day average for a month. The MACDs are turning lower, though the RSI is in neutral.

The US dollar has also been riding the 20-day moving average higher against the Mexican peso. It comes in now near MXN13.48. The greenback has lost some momentum in recent day but has not pulled back from the highs very much. There is no compelling technical evidence to conclude a dollar top is in place.