Some stocks or commodities generated poor or good returns for good reasons. Poor fundamentals or stretched valuations but selling for a high price will produce worse results. Improving fundamentals or modest valuations will produce good returns. The European stock markets performed poorly is understandable. Shanghai Composite Index generated closed to 50% losses is getting more attractive by days. The average PE for A shares selling for 11 times PE is very cheap. I have completed my visit in China. There is no doubt that it was slower than before but I could not find any signs of hard landing. The day of Reversion To Mean will come. My Dollar Averaging strategy has been activated recently. 20% of Turtle Portfolio cash will be moved into Chinese equities spread out over a period of 8 - 12 months.

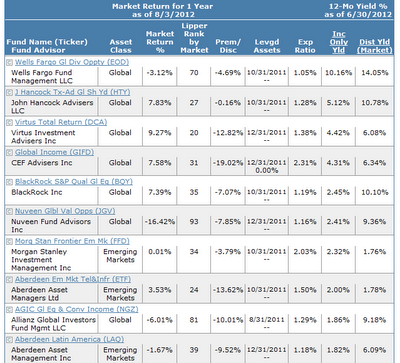

Funds that worth investigating:

1. Morgan Stanley China A Share Fund. It's a closed end fund listed in NYSE(CAF). It is selling close to 10% discount to NAV but with 13% market distribution yield is very attractive.

http://www.closed-endfunds.com/FundSelector/FundDetail.fs?ID=111897

2. United SSE 50 China ETF http://www.uobam.com.sg/uobam/html/china_etf.html

It is an ETF that has direct exposure to A shares listed in Singapore Stock Exchange. It has just recovered slightly after hitting a new low of USD 1.54.

3. BRIC mutual funds

4. Mutual funds specialize in H Shares

5. CIMBC25 listed in KLSE. I sold off last year at RM 0.83/share. It is about time to get back in soon.

Have a good weekend everyone.

Funds that worth investigating:

1. Morgan Stanley China A Share Fund. It's a closed end fund listed in NYSE(CAF). It is selling close to 10% discount to NAV but with 13% market distribution yield is very attractive.

http://www.closed-endfunds.com/FundSelector/FundDetail.fs?ID=111897

2. United SSE 50 China ETF http://www.uobam.com.sg/uobam/html/china_etf.html

It is an ETF that has direct exposure to A shares listed in Singapore Stock Exchange. It has just recovered slightly after hitting a new low of USD 1.54.

3. BRIC mutual funds

4. Mutual funds specialize in H Shares

5. CIMBC25 listed in KLSE. I sold off last year at RM 0.83/share. It is about time to get back in soon.

Have a good weekend everyone.

SUNDAY, AUGUST 5, 2012

iCapital. Deja Vu?

As of Aug 4, 2012, iCapital closed end fund was selling for RM 2.30 but NAV was RM 3.01, represents a discount of almost 24%. As of May 30, 2012, iCapital has net asset of RM 400 million and almost RM 133 millions are in cash. Investors may be sceptical that it can maintain its high elevated level.

The fund has never declare any dividend since it was launch in October 2005. In a few months time, the fund will be getting almost 7years. Using the market price around first week of October of every calender since it was listed we all can see that all the capital gain was in the first 2 years and return was practically non existent since 2008.

There are some interesting developments since last year with emergence of two foreign funds. One of them is City of London Investment Management Company LTD with initial interest of 5.26% in November 2011 and increased their holding to almost 6.2% as of July 31, 2012. The other fund is Lexey Partners Limited with initial interest of 5.92%. They started buying some time April 2012.

What Lexey Partners did reminded me of of a closed-end fund Amanah Millenia fund. That fund was forced to closed in 2007 after in existence of 10 years. Lexey Partners bought an initial interests of 5.05% with almost 29% discount to its NAV. After the initial interest, they kept buying until it reached 16.2% and forced it to close.

Amanah Millenia was way under-performing at that time in terms of NAV with 21.9% gains only over a period of 10 years while iCapital managed to improve its NAV over time of almost 3 times.

The question is will iCapital face a similar fate? Will this time be different with City of London Investment and Lexey Partners already accumulated combined interests of 12.7%.

Many of closed end funds in listed in NYSE actually paying dividend regularly. Many of closed end funds sweetened their investors with generous dividend to compensate for the discount to NAV.

Having foreign funds buying is a good news to current holders and certainly adding pressures to its fund manager. The mentality of foreign funds are very different from small holders will just wait patiently hoping something will happen. They will make things happen and it will be a big dent to TTB's pride if his fund get liquidated!

The fund has never declare any dividend since it was launch in October 2005. In a few months time, the fund will be getting almost 7years. Using the market price around first week of October of every calender since it was listed we all can see that all the capital gain was in the first 2 years and return was practically non existent since 2008.

There are some interesting developments since last year with emergence of two foreign funds. One of them is City of London Investment Management Company LTD with initial interest of 5.26% in November 2011 and increased their holding to almost 6.2% as of July 31, 2012. The other fund is Lexey Partners Limited with initial interest of 5.92%. They started buying some time April 2012.

What Lexey Partners did reminded me of of a closed-end fund Amanah Millenia fund. That fund was forced to closed in 2007 after in existence of 10 years. Lexey Partners bought an initial interests of 5.05% with almost 29% discount to its NAV. After the initial interest, they kept buying until it reached 16.2% and forced it to close.

Amanah Millenia was way under-performing at that time in terms of NAV with 21.9% gains only over a period of 10 years while iCapital managed to improve its NAV over time of almost 3 times.

The question is will iCapital face a similar fate? Will this time be different with City of London Investment and Lexey Partners already accumulated combined interests of 12.7%.

Many of closed end funds in listed in NYSE actually paying dividend regularly. Many of closed end funds sweetened their investors with generous dividend to compensate for the discount to NAV.

Having foreign funds buying is a good news to current holders and certainly adding pressures to its fund manager. The mentality of foreign funds are very different from small holders will just wait patiently hoping something will happen. They will make things happen and it will be a big dent to TTB's pride if his fund get liquidated!

0 comments:

Post a Comment