The worst week for global equities in almost two months finished on a positive note as optimism in the economy’s strength helped counter a procession of concerns from geopolitics to valuations and interest rates.

The Standard & Poor’s 500 Index lost 1.4 percent for the week, paring declines on the final day with a 0.9 percent rally. The MSCI All-Country World Index dropped 2 percent for the five days, the most since Aug. 1. The Russell 2000 Index of smaller companies decreased 2.4 percent. The MSCI Emerging Markets Index tumbled 2.8 percent, heading toward its worst month since January.

We have to remember that most equity markets are near or at their all time highs. What is different is that I DO NOT see any of these so called all time high markets experiencing crowd madness, euphoria driven rallies, blinkered decision making ... every single market, even at or near their all time highs have been relatively subdued.

That is the crux of the current rally. Is it a liquidity driven rally? Well any bull run has to be driven by cheap money. The only thing is that not many people want to gear up or take advantage of low interest rates to leverage up to participate in the markets. However, many corporations and funds have been more than willing to gear up. Many institutional funds are willing to look for better returns. Hence much of the INDEXED STOCKS highs are due to this, an accumulation by institutional funds ... hence you do not feel the euphoria so much.

The bulk of the activity has been in small caps, look at any market for the past 2 years. There certainly has been a flattening of many major property markets, not correction, but flattening out. We can surmise that a substantial amount of that liquidity may have trickled into equity markets, esp the smaller caps play.

However most equity markets traded sideways for the past week or so, MAINLY as there is an adjustment or realignment process going on in the global currencies arena. It appears there are some main conclusions reached by the majority:

a) Fed will raise interest rates very soon

b) resource led currencies will not get any help from China demand

c) Japan's reflationary tactics gaining traction

d) US recovery more solid and is diverging from EU

Equities fell early in the week as stronger economic data fueled concern the Federal Reserve may raise interest rates sooner than anticipated. The issue took a back seat on the final day as the S&P 500 rebounded from the biggest one-day decline since July on a report showing U.S. gross domestic product expanded in the second quarter at the fastest rate since 2011.

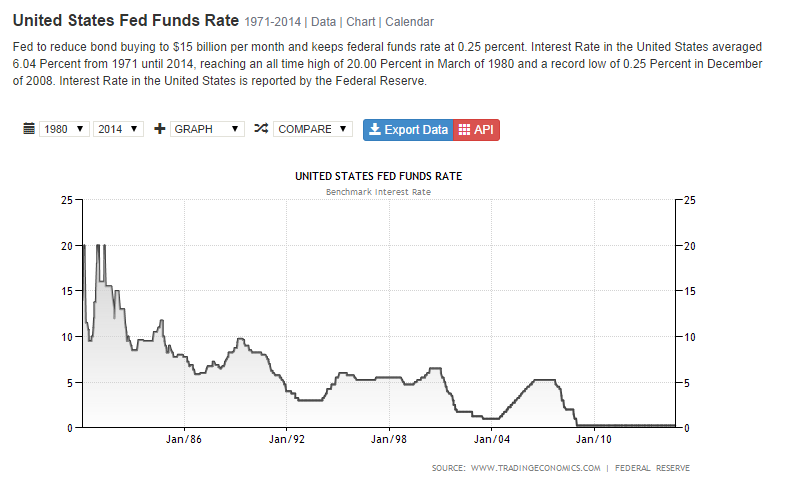

Interest Rates

Investors are analyzing reports to assess whether growth is strong enough to withstand higher rates. The S&P 500 reached a record on Sept. 18 after the Fed maintained a commitment to keep interest rates near zero for a considerable time after completing asset purchases. The Fed also said that the timing could move forward if data continues to exceed expectations.

Interest-rate concerns boosted the dollar, sending the greenback to a four-year high and its sixth straight week of gains. Its rally sent the MSCI Emerging Markets Index to a third week of losses. The gauge has tumbled 5.8 percent in September.

Reports for the week showed the U.S. economy rose at a 4.6 percent annualized rate in the second quarter, up from an August estimate of 4.2 percent. New-home sales surged to the highest level in more than six years, and American factories received more orders for machinery as an improving economy gave companies the confidence to expand.

The USD was set for the biggest monthly gain in more than two years as reports showing a stronger U.S. economy added to bets the Federal Reserve will boost interest rates sooner than its peers in Europe and Japan.

New Zealand’s dollar has tumbled 5.9 percent as central-bank Governor Graeme Wheeler called its level “unjustified,” one of policy makers’ criteria for intervention. The kiwi, nicknamed for the image of the flightless bird on the NZ$1 coin, reached 78.60 U.S. cents yesterday, the lowest level since September 2013.

The kiwi led currencies of commodity-exporting nations including the Australian dollar lower amid doubts about the sustainability of economic growth in China, the world’s second-biggest economy.

The yen fell as Health Minister Yasuhisa Shiozaki, whose ministry oversees the Government Pension Investment Fund, said pension reform would go ahead. Shiozaki said there’s no plan to postpone a law change that would improve governance of the Government Pension Investment Fund. A review of asset allocation may see it increase riskier investments, including foreign stocks and debt.

The Bank of Japan, which meets Oct. 7, is trying to boost inflation to 2 percent by pumping 60 trillion yen ($550 billion) to 70 trillion yen a year into the economy. BOJ Governor Haruhiko Kuroda said Sept. 18 in Tokyo he won’t hesitate to adjust monetary policy if needed.

The Fed is considering when to raise interest rates for the first time since 2006. There’s a 78 percent chance the benchmark rate target will go up by September 2015, according to fed-fund futures data compiled by Bloomberg.

So, what will happen? It appears that players used to very scared of any raising of rates by the Fed and were somehow too attached and reliant on QE measures to sustain interest in equities. However, I see a pronounced deviation from that view now. The increase in rates by Fed will actually be a lifting of a stumbling block as unemployment data looks too good to ignore. If the real economy is strengthening, one or even two rate hikes won't kill the market. Maybe the third strike.

I expect a vibrant equity market globally for the last quarter of 2014.

The Standard & Poor’s 500 Index lost 1.4 percent for the week, paring declines on the final day with a 0.9 percent rally. The MSCI All-Country World Index dropped 2 percent for the five days, the most since Aug. 1. The Russell 2000 Index of smaller companies decreased 2.4 percent. The MSCI Emerging Markets Index tumbled 2.8 percent, heading toward its worst month since January.

We have to remember that most equity markets are near or at their all time highs. What is different is that I DO NOT see any of these so called all time high markets experiencing crowd madness, euphoria driven rallies, blinkered decision making ... every single market, even at or near their all time highs have been relatively subdued.

That is the crux of the current rally. Is it a liquidity driven rally? Well any bull run has to be driven by cheap money. The only thing is that not many people want to gear up or take advantage of low interest rates to leverage up to participate in the markets. However, many corporations and funds have been more than willing to gear up. Many institutional funds are willing to look for better returns. Hence much of the INDEXED STOCKS highs are due to this, an accumulation by institutional funds ... hence you do not feel the euphoria so much.

The bulk of the activity has been in small caps, look at any market for the past 2 years. There certainly has been a flattening of many major property markets, not correction, but flattening out. We can surmise that a substantial amount of that liquidity may have trickled into equity markets, esp the smaller caps play.

However most equity markets traded sideways for the past week or so, MAINLY as there is an adjustment or realignment process going on in the global currencies arena. It appears there are some main conclusions reached by the majority:

a) Fed will raise interest rates very soon

b) resource led currencies will not get any help from China demand

c) Japan's reflationary tactics gaining traction

d) US recovery more solid and is diverging from EU

Equities fell early in the week as stronger economic data fueled concern the Federal Reserve may raise interest rates sooner than anticipated. The issue took a back seat on the final day as the S&P 500 rebounded from the biggest one-day decline since July on a report showing U.S. gross domestic product expanded in the second quarter at the fastest rate since 2011.

Interest Rates

Investors are analyzing reports to assess whether growth is strong enough to withstand higher rates. The S&P 500 reached a record on Sept. 18 after the Fed maintained a commitment to keep interest rates near zero for a considerable time after completing asset purchases. The Fed also said that the timing could move forward if data continues to exceed expectations.

Interest-rate concerns boosted the dollar, sending the greenback to a four-year high and its sixth straight week of gains. Its rally sent the MSCI Emerging Markets Index to a third week of losses. The gauge has tumbled 5.8 percent in September.

Reports for the week showed the U.S. economy rose at a 4.6 percent annualized rate in the second quarter, up from an August estimate of 4.2 percent. New-home sales surged to the highest level in more than six years, and American factories received more orders for machinery as an improving economy gave companies the confidence to expand.

The USD was set for the biggest monthly gain in more than two years as reports showing a stronger U.S. economy added to bets the Federal Reserve will boost interest rates sooner than its peers in Europe and Japan.

The greenback rose to the strongest level in 22 months versus the euro before the European Central Bank meets Oct. 2 to discuss the region’s slumping economy. The yen approached the weakest in six years amid slowing inflation and mixed signals on the speed of pension-fund changes. Emerging-market currencies headed lower, while the Bloomberg Dollar Spot Index reached the highest since 2010.

Brazil’s real is the biggest loser among the dollar’s 31 major counterparts this month as investors weighed voter support for President Dilma Rousseff in next month’s election amid a recession and inflation. The real has dropped 7.6 percent to 2.4201 per dollar, and it touched 2.4433 yesterday, the weakest since Jan. 29.New Zealand’s dollar has tumbled 5.9 percent as central-bank Governor Graeme Wheeler called its level “unjustified,” one of policy makers’ criteria for intervention. The kiwi, nicknamed for the image of the flightless bird on the NZ$1 coin, reached 78.60 U.S. cents yesterday, the lowest level since September 2013.

The kiwi led currencies of commodity-exporting nations including the Australian dollar lower amid doubts about the sustainability of economic growth in China, the world’s second-biggest economy.

The yen fell as Health Minister Yasuhisa Shiozaki, whose ministry oversees the Government Pension Investment Fund, said pension reform would go ahead. Shiozaki said there’s no plan to postpone a law change that would improve governance of the Government Pension Investment Fund. A review of asset allocation may see it increase riskier investments, including foreign stocks and debt.

The Bank of Japan, which meets Oct. 7, is trying to boost inflation to 2 percent by pumping 60 trillion yen ($550 billion) to 70 trillion yen a year into the economy. BOJ Governor Haruhiko Kuroda said Sept. 18 in Tokyo he won’t hesitate to adjust monetary policy if needed.

The Fed is considering when to raise interest rates for the first time since 2006. There’s a 78 percent chance the benchmark rate target will go up by September 2015, according to fed-fund futures data compiled by Bloomberg.

So, what will happen? It appears that players used to very scared of any raising of rates by the Fed and were somehow too attached and reliant on QE measures to sustain interest in equities. However, I see a pronounced deviation from that view now. The increase in rates by Fed will actually be a lifting of a stumbling block as unemployment data looks too good to ignore. If the real economy is strengthening, one or even two rate hikes won't kill the market. Maybe the third strike.

I expect a vibrant equity market globally for the last quarter of 2014.